We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will manage your bookkeeping and file taxes for you. Finding an accountant to manage your bookkeeping and file taxes is a big is a note receivable a current asset decision. Set your business up for success with our free small business tax calculator. Free up time in your firm all year by contracting monthly bookkeeping tasks to our platform. Save more by mixing and matching the bookkeeping, tax, and consultation services you need.

Format of Notes Receivable

A Note Receivable is recorded when a company is on the “receiving” side of a debt. A Note Payable is recorded when a company is on the “paying” side of a debt. The difference in recording is based on which side of the transaction a company is on. Notice that the sign for the $7,835 PV is preceded by the +/- symbol, meaning that the PV amount is to have the opposite symbol to the $10,000 FV amount, shown as a positive value. This is because the FV is the cash received at maturity or cash inflow (positive value), while the PV is the cash lent or a cash outflow (opposite or negative value).

Key Components of Notes Receivable

Square determines the amount to be charged for the loan and the percentage to be charged each day using data analytics. Each Square account has potentially different terms based on its history and trends. Assume if RSP was unable to pay the final installment of USD20,000 and the related interest of USD165 and MPC has been accruing this interest income. MPC has to write off the remaining balance of the note with interest due. For example, a company may provide a loan to another company in exchange for a note.

Defaulted Notes Receivable

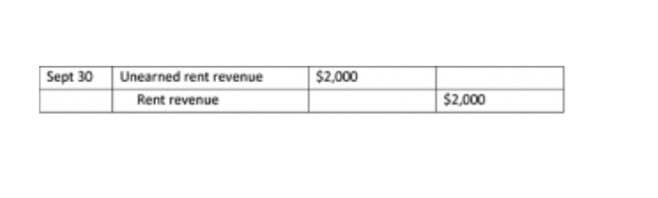

Interest on a note receivable is calculated by multiplying the principal balance of the note by the interest rate and by the number of days that have elapsed since the last interest payment was made divided by 365. The journal entry for interest on a note receivable is to debit the interest income account and credit the cash account. Both accounts receivable and notes receivable can be used to generate immediate cash. There are several elements of promissory notes that are important to a full understanding of accounting for these notes.

What is notes receivable?

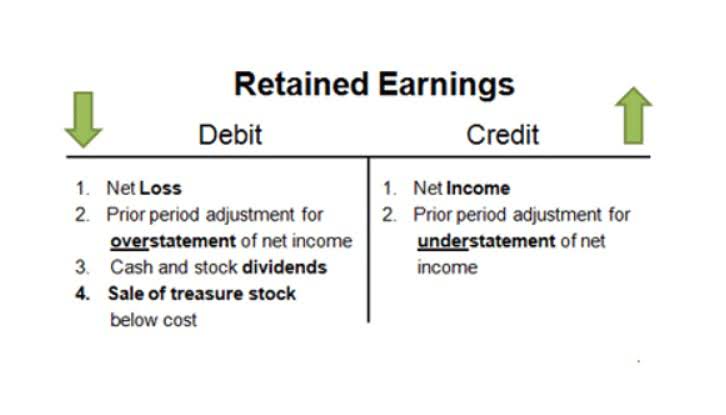

They will be reported as either current or non-current assets depending on the timeframe in which there are expected to be paid. That is, they describe a financial resource that can be converted to cash soon, once the customer has paid. Similarly, they are the basis for measuring the business’s ability to convert sales into cash. Current Assets is always the first account listed in a company’s balance sheet under the Assets section. It is comprised of sub-accounts that make up the Current Assets account. For example, Apple, Inc. lists several sub-accounts under Current Assets that combine to make up total current assets, which is the value of all Current Assets sub-accounts.

Discounting notes receivables:

For example, if a customer fails to pay back a note that is ten months overdue, this would need to be written off as a bad debt expense. Notes receivables are written promissory notes which give the holder or bearer the right to receive the amount mentioned in the agreement. Sometimes accounts receivables are converted into notes receivables to allow the debtors to pay the balance.

- Before realization of the maturity date, the note is accumulating interest revenue for the lender.

- Notes receivables describe promissory notes that represent loans paid from a company or business to another party.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- A customer may give a note to a business for an amount due on an account receivable or for the sale of a large item such as a refrigerator.

- For each sale, you issue a notes receivable to the company, with an interest rate of 10% and a maturity date 18 months after the issue date.

- To show the initial recording of notes receivable, assume that on 1 July, the Fenton Company accepts a $2,000, 12%, 4-month note receivable from the Zoe Company in settlement of an open account receivable.

The portion of ExxonMobil’s balance sheet pictured below from its 10-K 2021 annual filing displays where you will find current and noncurrent assets. Noncurrent assets are a company’s long-term investments, and cannot be converted to cash easily within a year. They are required for the long-term needs of a business and include things like land and heavy equipment. Later, when the note is paid in full, the store will record a journal entry of the same amount plus interest in the debit column for cash. It will also record a $25,000 entry as a debit for notes receivable to cancel out the original transaction. Like accounts receivable, notes receivable are recorded as an asset because they represent monetary value that the business expects to collect.